Condizioni di trading

Strumenti

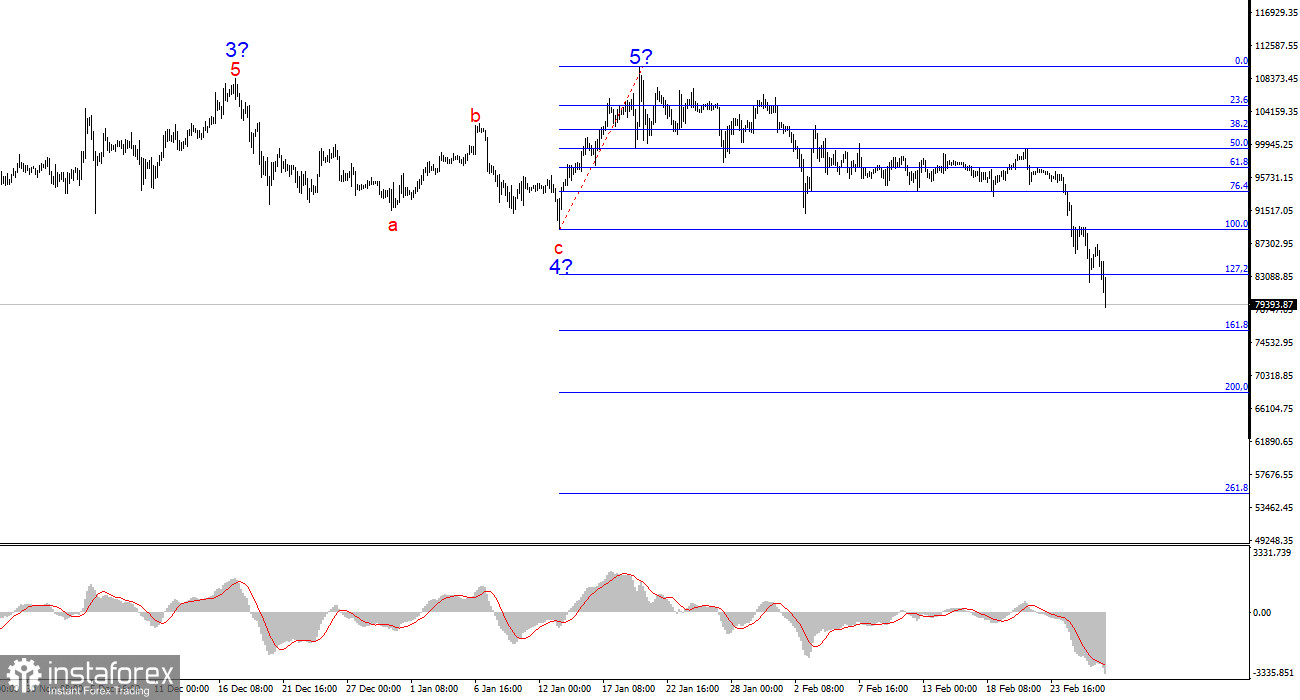

The wave pattern on the 4-hour chart appears quite clear. After a prolonged and complex corrective structure (a-b-c-d-e) from March 14 to August 5, a new impulsive wave began, forming a five-wave pattern. Given the size of wave 1, the fifth wave was likely truncated. Based on this, I did not expect and still do not expect Bitcoin to rise above $110,000–$115,000 in the coming months.

Another key observation is wave 4, which formed a three-wave structure, confirming the validity of the current wave count. Bitcoin's previous rally was fueled by continuous institutional investment, government purchases, and pension fund inflows. However, Donald Trump's policies have driven investors out of the market, and no trend can remain bullish indefinitely. The wave that began on January 20 does not resemble the first impulse wave, indicating that we are dealing with a complex corrective structure that could persist for months.

Over the past eight days, Bitcoin has plunged by $18,000, and Friday's session is not over yet. By the end of the day, we could see Bitcoin trading well below $80,000. The market is in a state of near panic, though this crash does not seem to have been triggered by a single event.

I have been warning for weeks that Trump's protectionist policies would not benefit the U.S. economy, the crypto sector, or stock markets. As we can see now, the economy is slowing down, the cryptocurrency market is collapsing, and stock indices, after two years of growth, have also begun to tumble.

There are multiple reasons for this downturn. Trump promised to create a Bitcoin reserve—but did not follow through. He introduced or plans to introduce a series of tariffs on major trading partners. In response, key trading partners are implementing retaliatory tariffs against the U.S. The global economy is slowing down as a result. Trump continues to make unilateral decisions, often disrespecting international leaders.

These factors deter investors from taking risks, and Bitcoin is not considered a safe-haven asset.

Even if Trump's policies are not the direct cause of Bitcoin's crash, I expected a downturn anyway. Bitcoin has been rallying for two years, and historically, its bullish trends rarely exceed that timeframe. The wave structure signaled that wave 5 was truncated and complete, meaning the only logical next step was a decline.

Based on my analysis, Bitcoin's rally is over for now. The current trend suggests a prolonged correction, which is why I previously advised against buying cryptocurrencies—and even more so now.

A break below the low of wave 4 confirms that Bitcoin has entered a downward trend, likely a corrective phase. The best strategy remains to look for selling opportunities on lower timeframes. Bitcoin could fall to $76,000 (161.8% Fibonacci level) as soon as today.

On the higher timeframes, we see a five-wave bullish structure that is now transitioning into a corrective or full-fledged bearish trend.

Key Principles of My Analysis:

Le recensioni analitiche di InstaForex ti renderanno pienamente consapevole delle tendenze del mercato! Essendo un cliente InstaForex, ti viene fornito un gran numero di servizi gratuiti per il trading efficiente.

Potremmo utilizzare i cookie per analizzare i dati dei visitatori, migliorare il nostro sito web e misurare le performance della pubblicità. In generale, questi dati vengono utilizzati per fornire una migliore esperienza sul sito web. Maggiori informazioni.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Rimani

Rimani