Condizioni di trading

Strumenti

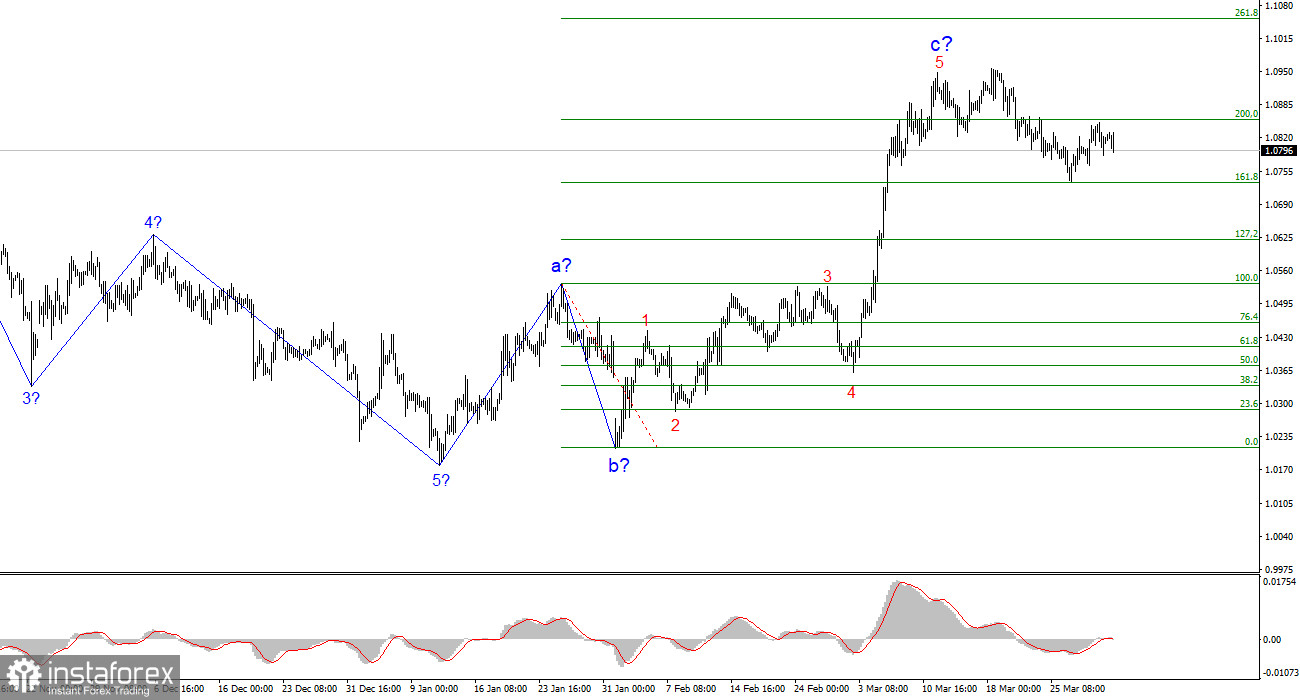

The wave structure on the 4-hour EUR/USD chart risks evolving into a more complex formation. On September 25 of last year, a new bearish structure began to take shape, forming an impulsive five-wave pattern. Three months ago, an upward corrective pattern began, which should consist of at least three waves. The structure of the first wave was relatively clear, so I'm still expecting the second wave to take a distinct form. However, its size is now so large that there's a real risk of the wave layout undergoing a serious transformation.

The fundamental backdrop continues to support sellers more than buyers, at least from a data perspective. All U.S. reports in recent months have shown one thing—the economy is not facing serious problems and shows no signs of slowing to worrying levels. However, this could change significantly in 2025 due to Donald Trump's policies. The Fed might cut interest rates more times than expected, while tariffs and retaliatory measures could hurt economic growth. If it weren't for recent developments, I would still expect the euro to decline with a 90% probability. But it's still possible.

The EUR/USD pair fell by just a few dozen points on Tuesday—a small move for a supposedly strong dollar. Yesterday, German inflation slowed to 2.2% year-on-year. Today, inflation in the eurozone also slowed to 2.2%. These reports indicate there is no real need for the ECB to pause its monetary easing. Naturally, the ECB is wary of Trump's tariffs, details of which could be announced today or tomorrow. Economists have already calculated that prices for nearly all cars worldwide will rise because of the new U.S. duties—even those manufactured in the United States. That means rising prices and accelerating inflation, especially for high-cost goods. Therefore, fears of renewed consumer price growth are justified—not only in the EU, but also in the U.S. and globally. The big question is: how sharply will inflation rise, and what other tariffs might Trump introduce?

In my view, the market is currently juggling an overwhelming number of factors and possible future economic shifts. With so much uncertainty, it's in no hurry to form new positions. Demand for the dollar is slowly increasing, but this is likely due to profit-taking on dollar shorts accumulated over recent months. The wave picture still points to a continuation of the bearish trend—but to buy the dollar, the market needs clear reasons. And what could those reasons be if Trump is constantly threatening, imposing tariffs, making demands, and issuing ultimatums?

Still, I don't want to ignore the wave count entirely, so I continue to expect a decline in the pair.

Based on this EUR/USD analysis, I conclude that the pair is continuing to build a bearish trend segment—but in the near future, it could turn bullish. A new upward push in the euro would transform the entire wave structure. Since the news backdrop currently contradicts the wave count, I can't recommend selling the pair, even though the current levels look extremely attractive for shorting—if the wave pattern remains intact. Everything will depend on how strongly the market continues to react to Trump's tariff policies and what additional tariffs the Republican president may introduce.

On the higher wave scale, the pattern has transitioned into an impulsive structure. A new long-term bearish wave sequence is likely ahead, though the news backdrop—particularly driven by Trump—could completely flip market expectations.

Key Principles of My Analysis:

Wave analysis can be combined with other types of analysis and trading strategies.

Le recensioni analitiche di InstaForex ti renderanno pienamente consapevole delle tendenze del mercato! Essendo un cliente InstaForex, ti viene fornito un gran numero di servizi gratuiti per il trading efficiente.

Potremmo utilizzare i cookie per analizzare i dati dei visitatori, migliorare il nostro sito web e misurare le performance della pubblicità. In generale, questi dati vengono utilizzati per fornire una migliore esperienza sul sito web. Maggiori informazioni.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Rimani

Rimani