Condizioni di trading

Strumenti

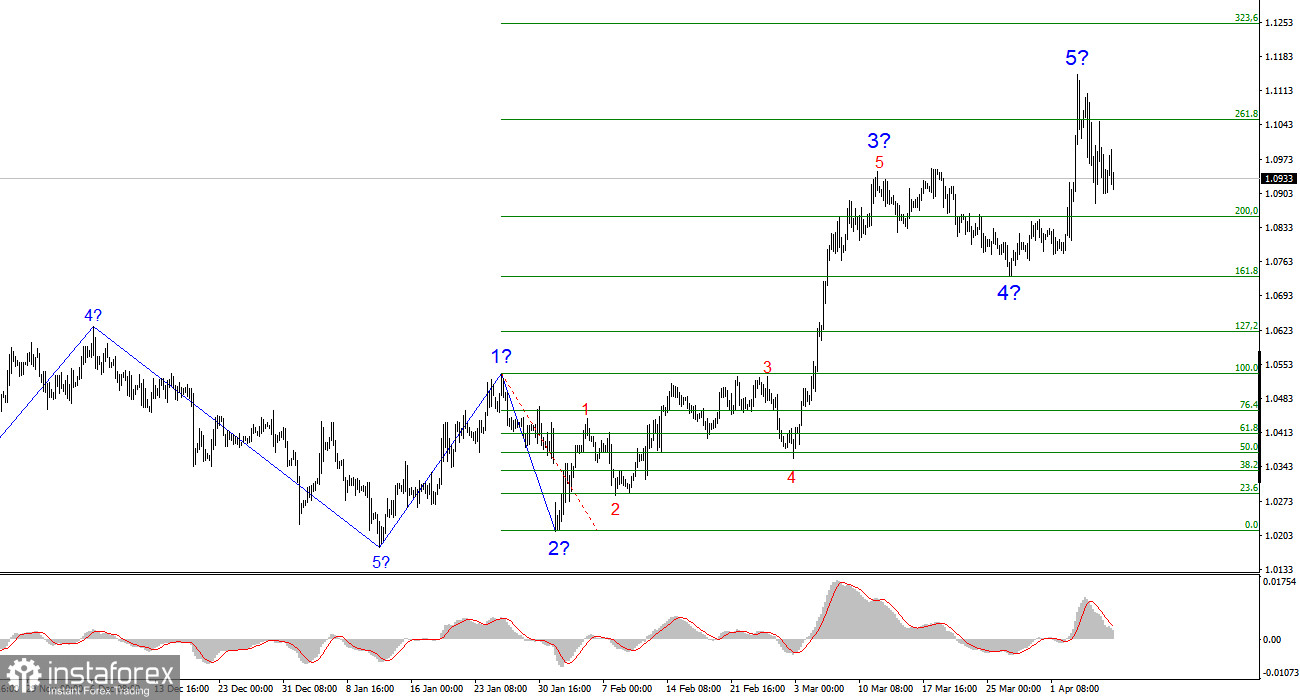

The wave pattern on the 4-hour chart for EUR/USD has transformed into a bullish one. I believe there is little doubt that this transformation is entirely due to the new U.S. trade policy. Until February 28, when the U.S. dollar began its sharp decline, the entire wave structure looked like a convincing bearish trend segment. A corrective wave 2 was forming. However, weekly statements from Donald Trump about new tariffs had their effect. Demand for the U.S. dollar started to fall rapidly, and now the entire trend segment that began on January 13 has taken on a five-wave impulsive structure.

Based on this, we should now expect the formation of corrective wave 2 of the new upward trend segment, which may consist of three waves. After that, the U.S. dollar is likely to continue its decline — unless Donald Trump makes a complete U-turn on his trade policy. This is a clear example of how the news backdrop can change a wave pattern.

The EUR/USD pair saw little movement on Tuesday heading into the U.S. session, although the intraday range could hardly be described as "narrow." The market is slowly stabilizing and realizing that another "battle" has taken place, and now it's time for a "breather." Thus, we may indeed see a couple of quiet days in the market, but I don't believe anyone seriously expects an end to the trade war escalation or a complete reversal in the U.S. trade policy direction.

Yesterday and today, the markets have been actively discussing the EU's countermeasures — not just the markets, but also European politicians. Initially, a tariff package worth 28 billion dollars was proposed, but it quickly seemed laughable, considering Trump imposed tariffs on European goods totaling half a trillion dollars. EU losses could amount to around 100 billion dollars. Later, the European Commission began discussing a more "mirror-like" response. The EU government is now proposing 25% tariffs on all imports from the U.S. Brussels is also willing to compromise, offering mutual zero tariffs on all industrial goods. However, Trump's stance remains firm: the EU was created to rob America and owes it a lot of money. Therefore, according to him, either the EU will pay, or there will be a trade war. It's worth noting that Europe doesn't seem to believe much in the success of negotiations with Trump. Meanwhile, the U.S. president is already threatening additional tariffs if Brussels retaliates. In other words, the story isn't over yet, and it's too early to relax.

Based on the conducted EUR/USD analysis, I conclude that the pair has started forming a new upward trend segment. The only serious concern is Donald Trump. If his actions could reverse one trend, they could easily reverse another. Therefore, in the near term, wave structure will depend entirely on the U.S. president's stance and actions. This must be kept in mind constantly. Based solely on the wave pattern, a corrective wave set — typically three waves — is now expected. After that, a new bullish wave is likely, and traders should look for long entry opportunities with targets well above the 1.10 level.

On the higher wave scale, it's evident that the wave pattern has turned bullish. A long-term upward wave sequence is likely ahead, but Trump's news flow alone could still flip the market upside down once again.

Core Principles of My Analysis:

Le recensioni analitiche di InstaForex ti renderanno pienamente consapevole delle tendenze del mercato! Essendo un cliente InstaForex, ti viene fornito un gran numero di servizi gratuiti per il trading efficiente.

Potremmo utilizzare i cookie per analizzare i dati dei visitatori, migliorare il nostro sito web e misurare le performance della pubblicità. In generale, questi dati vengono utilizzati per fornire una migliore esperienza sul sito web. Maggiori informazioni.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Rimani

Rimani