was formed on 03.04 at 18:04:53 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of NZDCHF M5. Features of the pattern: The lower line of the pattern has coordinates 0.5003 with the upper limit 0.5003/0.4998, the projection of the width is 13 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 0.4990, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- Double Top

- Flag

- Head and Shoulders

- Pennant

- Rectangle

- Triangle

- Triple top

- All

- #AAPL

- #AMZN

- #EBAY

- #FB

- #GOOG

- #INTC

- #KO

- #MA

- #MCD

- #MSFT

- #NTDOY

- #PEP

- #TSLA

- #TWTR

- AUDCAD

- AUDCHF

- AUDJPY

- AUDUSD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- EURRUB

- EURUSD

- GBPAUD

- GBPCHF

- GBPJPY

- GBPUSD

- GOLD

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SILVER

- USDCAD

- USDCHF

- USDJPY

- USDRUB

- All

- M5

- M15

- M30

- H1

- D1

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

The Double Top pattern has been formed on #KO M5. It signals that the trend has been changed from upwards to downwards. Probably, if the base of the pattern 72.00

The M5 and M15 time frames may have more false entry points.

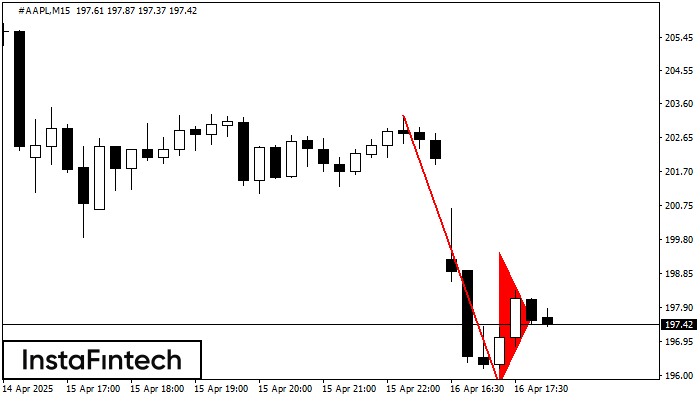

Open chart in a new windowThe Bearish Flag pattern has been formed on the chart #AAPL M15. Therefore, the downwards trend is likely to continue in the nearest term. As soon as the price breaks

The M5 and M15 time frames may have more false entry points.

Open chart in a new windowThe Bearish pennant pattern has formed on the #AAPL M15 chart. This pattern type is characterized by a slight slowdown after which the price will move in the direction

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Stay

Stay