Warunki handlowe

Narzędzia

On Tuesday, the U.S. stock market closed on a declining note. Key factors were the mixed financial results of Morgan Stanley and Goldman Sachs, which pressured the banking sector, and the sale of Boeing and Apple stocks, which impacted the S&P 500 index's decline.

Morgan Stanley (MS.N) shares fell by 4.2%, reaching a month's low after reporting a quarterly profit decline. Meanwhile, Goldman Sachs (GS.N) shares ended 0.7% higher due to a 51% profit increase.

The S&P 500 banking sector index (.SPXBK) fell by 1.2%, also reaching a month's low following other major U.S. banks reporting profit declines on Friday.

Spirit Airlines (SAVE.N) shares fell by 47% following a federal court decision to block JetBlue Airways' (JBLU.O) planned $3.8 billion acquisition, agreeing with the U.S. Department of Justice that the deal could harm consumers.

Apple (AAPL.O) shares fell by 1.2% following the company's rare iPhone discounts in China in response to fierce competition, shortly after being overtaken by Microsoft (MSFT.O) as the world's most valuable company.

Christopher Waller, head of the Federal Reserve, made a statement that tempered market expectations regarding a swift reduction in interest rates. He expressed confidence that inflation would reach the Fed's target of 2% but emphasized the need for a measured approach to rate changes.

This statement affected traders' assessments, now less inclined to expect a Fed rate cut as early as March. Consequently, the yield on U.S. Treasury bonds showed an increase.

Amid these events, investors also paid attention to various political and geopolitical happenings. These included Donald Trump's victory in the first Republican presidential contest of 2024 in Iowa, as well as events in the Red Sea, the Gaza Strip, and Ukraine.

The U.S. dollar index (.DXY) strengthened by 0.95%, while the euro weakened by 0.69%, falling to 1.0872 dollars.

The Japanese yen showed a decrease of 1.02% against the dollar, reaching 147.27 yen per dollar. The British pound sterling also experienced a decline, trading at $1.2632, down by 0.73% for the day.

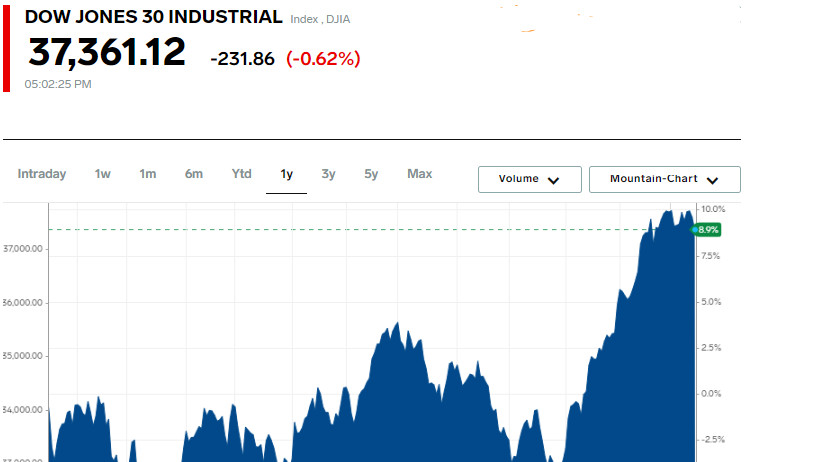

On the stock market, the Dow Jones Industrial Average (.DJI) fell by 231.86 points, or 0.62%, closing at 37,361.12. The S&P 500 (.SPX) lost 17.85 points, or 0.37%, falling to

4,765.98, while the Nasdaq Composite (.IXIC) dropped by 28.41 points, or 0.19%, to 14,944.35.

These figures reflect the current state of the financial markets, reacting to a combination of macroeconomic indicators, political news, and geopolitical events, affecting global economic outlooks.

The yield on U.S. Treasury bonds rose amidst a weakening of bullish sentiments in the previous week, and central bankers dismissed expectations of a relaxation in monetary policy.

The rate on 10-year U.S. government bonds increased, last trading down 31/32, leading to a yield of 4.0676% compared to 3.95% at Friday's close.

30-year bonds also showed a decline, falling 63/32, which led to an increase in yield to 4.3072% from the previous 4.198%.

U.S. crude oil prices fell, driven by the dollar's rise amid expectations of interest rate cuts and meteorologists' predictions of an unusually warm January.

U.S. crude oil WTI fell by 0.39%, reaching a price of $72.40 per barrel, while Brent crude fell to $78.29, representing a 0.18% increase for the day.

Gold prices also declined following Waller's hawkish statements and amid a strengthening dollar. Spot gold dropped by 1.3% to $2,027.89 per ounce.

Shares of Advanced Micro Devices (AMD.O) rose by 8.3% after analysts at Barclays upgraded their price forecasts for AMD and other chip manufacturers, noting their potential benefit from the growth of artificial intelligence. A larger competitor in this sector, Nvidia (NVDA.O), also showed growth, increasing by about 3% and reaching a historic high.

Boeing (BA.N) experienced a significant drop of nearly 8%, reaching a two-month low. This occurred after the Federal Aviation Administration extended the indefinite suspension of the operation of 737 MAX 9 aircraft, and Wells Fargo downgraded the company's stock rating from "overweight" to "equal weight."

These dynamic changes in the financial markets reflect the interplay between macroeconomic indicators, corporate news, and geopolitical events, influencing the global economic climate.

Dzięki analizom InstaForex zawsze będziesz na bieżące z trendami rynkowymi! Zarejestruj się w InstaForex i uzyskaj dostęp do jeszcze większej liczby bezpłatnych usług dla zyskownego handlu.

Możemy używać plików cookies do analizowania danych odwiedzających, ulepszania naszej strony internetowej i pomiaru wydajności reklam. Dane te są wykorzystywane w celu zapewnienia lepszej obsługi naszej strony internetowej. Więcej informacji.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Anuluj

Anuluj