Condições de Negociações

Ferramentas

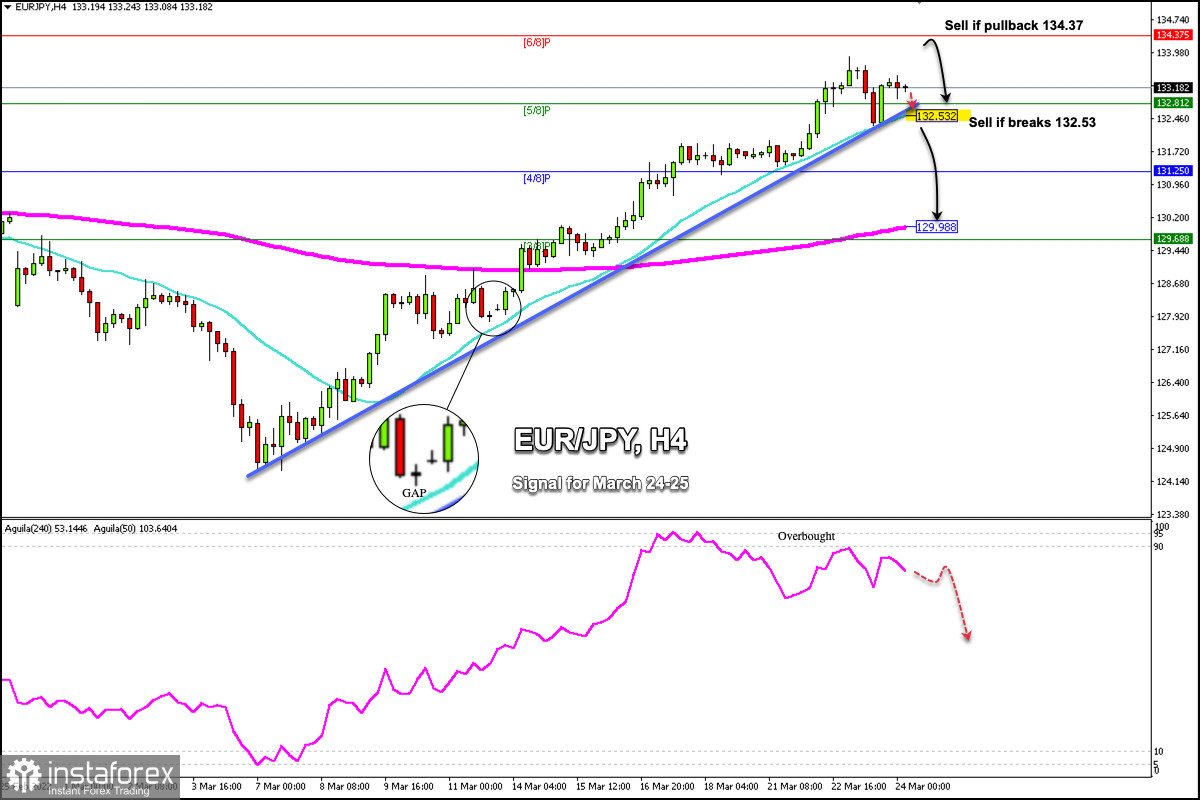

On March 23, EUR/JPY reached a high of 133.88, the level last seen on June 03, 2021.

The latest candles formed on the 4-hour chart below 133.88 confirm that the market could enter a correction phase. However, the cross should sharply break the uptrend channel and consolidate below the 21 SMA located at 132.53.

The area 134.00 has become a barrier for EURJPY causing a corrective drop below this level. If this level of 134.00 is broken, the next potential target would be 134.37 (6/8 Murray). This level is strong resistance, hence a failure to consolidate above will give us an opportunity to sell.

Conversely, with a bearish reversal below the 21 SMA at 132.53 we could see a decline towards support of 3/8 Murray and the 200 EMA at 129.98 and 129.68. A daily close below 129.50 could accelerate the decline to cover the GAP at 125.98.

According to the 4-hour chart, we can see that since the beginning of March EUR/JPY started a rally. We can see that the price has been moving above the uptrend channel which indicates that the bias is still bullish and the pair could reach the resistance area of 134.37.

The dovish policy of the Bank of Japan has helped EUR/JPY to gain most of the ground lost in February.

The Bank of Japan confirmed its ultra-expansive monetary policy at its last meeting in March. The bank pledged to maintain its massive stimulus program despite rising inflation trends.

As long as the currency pair remains above the 200 EMA, today at 129.98, the outlook for EUR/JPY is expected to remain bullis, but it should first make a correction towards the psychological level of 130.00.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

Podemos usar cookies para analisar os dados dos nossos visitantes, melhorar nosso site e medir o desempenho da publicidade. No geral, esses dados são usados para proporcionar uma melhor experiência no site. Mais informações.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Permanecer

Permanecer