Condições de Negociações

Ferramentas

The EUR/USD currency pair displayed a highly unusual move on Friday (as we noted over the weekend). To recap, key reports that the market had been anticipating all week (or possibly even longer) failed dramatically. The Nonfarm Payrolls (NFP) figure fell far short of even the lowest forecasts, and although factors like U.S. hurricanes that affected the October figure are discussed, the result remains disappointing. As we mentioned over the weekend, the dollar's rise on poor NFP results was illogical, so a subsequent decline was expected—precisely what happened on Monday.

Thus, the EUR/USD pair has finally started a corrective upward movement. This development is unsurprising, as various indicators have been signaling this for the past two to three weeks. We still expect a downward trend in the medium term, but the pair may correct by another 100 pips this week.

Of course, everything now depends on the upcoming Federal Reserve meeting. Given the poor labor market report, we can expect a more dovish tone, perhaps even a rate cut of 0.5% (although unlikely) or any action that could increase pressure on the dollar. However, we believe the market has already wholly or almost entirely priced in the Federal Reserve's monetary easing cycle, meaning there are no grounds for a significant drop in the U.S. dollar. We anticipate a correction, followed by the resumption of the downtrend that has been forming over the past month.

It's worth noting that another key report, the ISM Manufacturing PMI, also missed expectations badly. Although seeing this indicator below the 50.0 threshold is no longer surprising, October's figure fell even further. While the ISM index doesn't currently impact the economic outlook, it certainly doesn't help the dollar. Thus, there were ample reasons for a dollar decline on Friday. Monday saw a "restoration of fair value." Everything depends on the Fed's actions and the U.S. presidential election results, and both are happening this week.

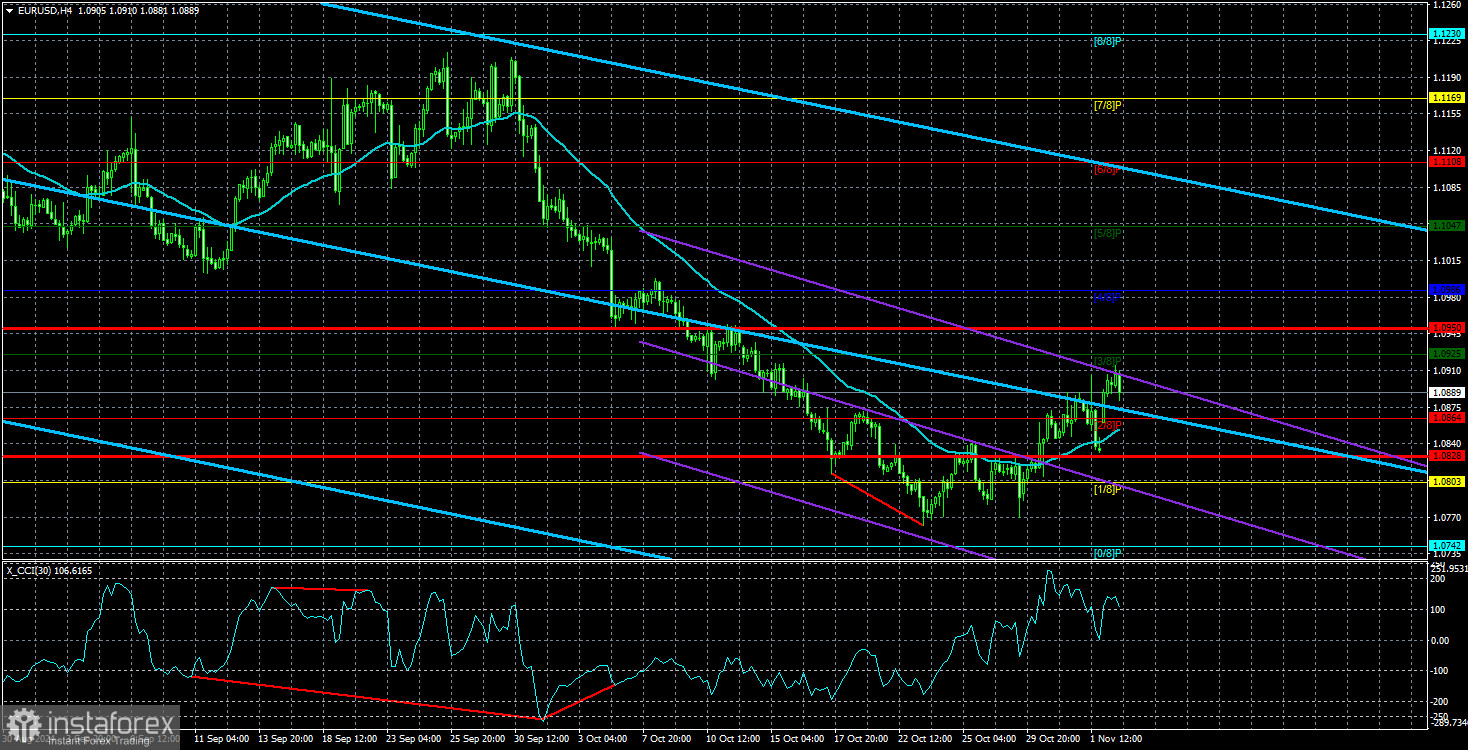

The average volatility of the EUR/USD pair over the last five trading days is currently at 61 pips, classified as "low." On Tuesday, we expect the pair to move between the levels of 1.0828 and 1.0950. The higher linear regression channel has turned downward, indicating that the global downtrend remains intact. The CCI indicator has formed several bullish divergences, signaling a potential correction.

Nearest Support Levels:

Nearest Resistance Levels:

The EUR/USD pair has started a correction. Over recent weeks, we've emphasized our medium-term expectation for euro weakness, so we fully support the downtrend. It's possible that the market has priced in all or almost all expected Fed rate cuts. If that's the case, the dollar may lack further bearish catalysts. Short positions remain valid with targets at 1.0761 and 1.0742 as long as the price stays below the moving average. If you're trading based on pure technicals, long positions are currently relevant with targets of 1.0925 and 1.0950, though this is only a corrective phase.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

Podemos usar cookies para analisar os dados dos nossos visitantes, melhorar nosso site e medir o desempenho da publicidade. No geral, esses dados são usados para proporcionar uma melhor experiência no site. Mais informações.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Permanecer

Permanecer