#BHP (BHP Billiton Limited). Výmenný kurz a online grafy

Currency converter

28 Feb 2023 22:59

(0%)

Uzatváracia cena predchádzajúceho dňa.

Cena na ktorej otvoril daný deň.

Najvyššia cena počas posledného obchodného dňa.

Najnižšia cena počas posledného obchodného dňa

Celková hodnota spoločnosti na akciovom trhu. Vo všeobecnosti sa vypočíta ako násobok počtu akcií v obehu a aktuálnej ceny za jednu akciu.

Počet akcií držaných investormi a majiteľmi spoločnosti, okrem tzv. rozrieďujúcich cenných papierov ako sú neodňateľné RSU a neuplatnené opcie.

BHP is a ticker symbol for the shares of BHP Billiton, which are traded on the LSE (London), JSE (Johannesburg), ASX (Australia), as well as in the form of American depositary receipts (ADRs) on the NYSE (New York).

BHP Billiton conducts exploration, development, production, processing of oil, gas, iron ore, metallurgical coal, diamonds, non-ferrous, and precious metals.

Technically, BHP Billiton consists of 2 companies: BHP Billiton Limited (Australia) and BHP Billiton Plc. (the UK and the Netherlands). It has 2 headquarters: the head office is located in Melbourne and the second one in London. For the same reason, the shares of Australian and British divisions of BHP are traded on the exchanges independently of each other.

History

Since BHP Billiton was established in 2001 in The Hague as a result of a merger of 2 companies, its history can be divided into 2 parts.

BHP Billiton Limited located in Australia was founded in 1885. It started with the field exploration of lead, zinc, and silver deposits. In 1899 it produced iron ore in the Iron Knob deposit.

After the First World War, the company bought up deposits of coal, iron ore, as well as enterprises that produced finished steel products. In 1967, Billiton Limited (Bass Strait) began the oil business. Since the 1970s, it has been engaged in the development of foreign deposits: copper in Chile, coal in New Mexico, diamond in Canada in the 1990s, and natural gas in offshore zones of Australia.

BHP Billiton Plc. (the UK division) began to mine bauxite in 1851 in Indonesia on the island of Billiton. The company was registered 9 years later in 1860. In 1935-1939, BHP Billiton Plc. produced bauxite on the island of Suriname, Indonesia, and 20 years later in Guinea-Bissau. In 1978-1987, it built numerous factories in Europe. In 1997, the company was listed on the London Stock Exchange.

Merger

At the time of the merger with BHP Billiton Group in 2001, the companies agreed to keep their separate identities and listings on the Australian and London stock exchanges. BHP owns 58% of the new company and Billiton holds 42%. The merger was strategically beneficial for Billiton Ltd. with free margin but a slow pace of development, while Billiton Plc. was a dynamically growing company that lacked the funds to consolidate the assets.

The company uses special schemes for dealing with Austrian and European shares: the dividends are paid equally but the shareholders' meetings are held separately. At the same time, BHP Billiton is managed by two equal boards of directors and a CEO.

Revenue and achievements

In 2005, BHP Billiton was recognized as the most successful company of the year among 2,200 companies from 24 countries.

In 2004, the turnover totaled $24.8 billion with a net profit of $5.5 billion. In 2019, net profit amounted to $8.31 billion and was the highest in the last five years.

Nowadays, BHP Billiton is the world's largest diversified mining company in the field of extraction and use of natural resources. Its global technology divisions have research centers in Australia, South Africa, China, etc.

The corporation is engaged in more than 100 projects in 26 countries around the world. BHP Billiton is constantly expanding, buying up assets, and creating a joint venture with the largest mining companies on all continents. The number of employees amounts to 72,000. In 2018, its assets totaled $111.993 billion. The company's revenue is $44.29 billion (as of 2019).

Pozrite si tiež

- Gold forecasts are becoming increasingly dazzling in every sense, as analysts appear to be competing with one another over how high the precious metal could go. Rising geopolitical instability and President Donald Trump's current

Autor: Larisa Kolesnikova

11:07 2025-04-09 UTC+2

1555

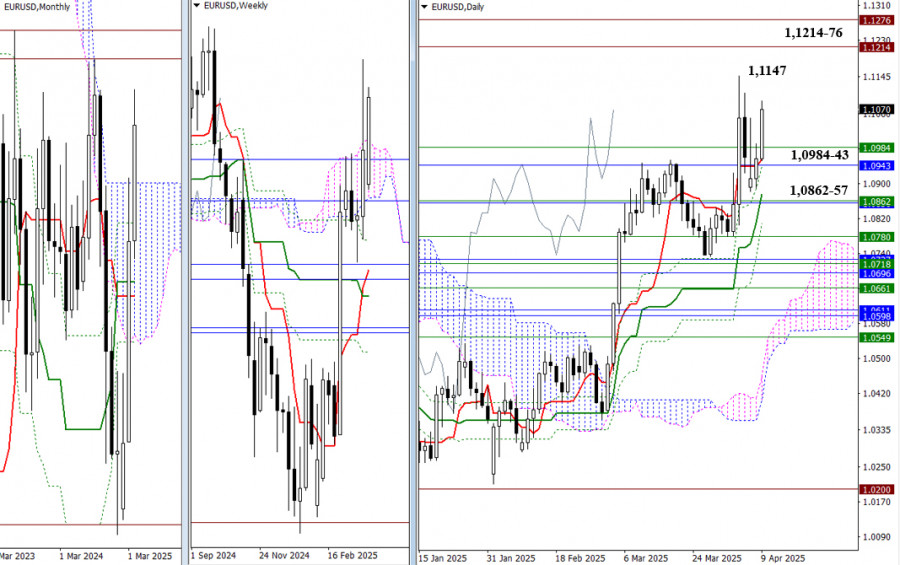

The bulls are attempting to regain control, and we are currently observing increased activity and a push toward the peak of the ongoing correction at 1.1147. A breakout above this level would shift the market's focus to historical resistance atAutor: Evangelos Poulakis

10:07 2025-04-09 UTC+2

1480

ForecastUSD/JPY: Simple Trading Tips for Beginner Traders on April 9. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 9. Review of Yesterday's Forex TradesAutor: Jakub Novak

08:45 2025-04-09 UTC+2

1405

- Forecast

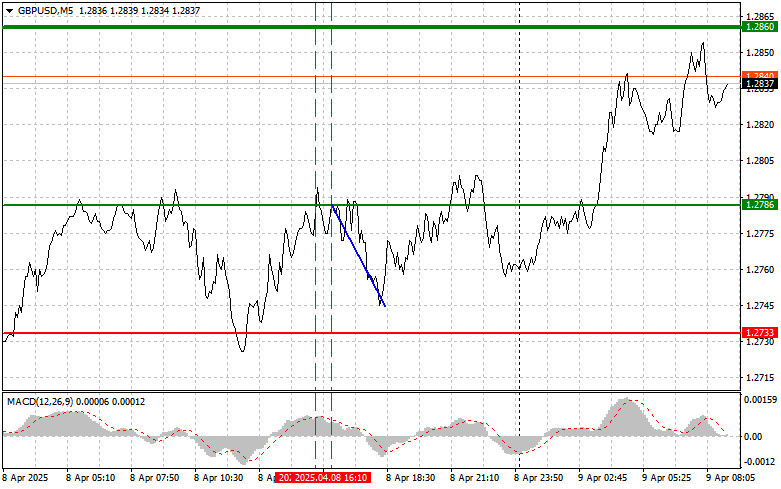

GBP/USD: Simple Trading Tips for Beginner Traders on April 9. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on April 9. Review of Yesterday's Forex TradesAutor: Jakub Novak

08:44 2025-04-09 UTC+2

1390

Trump's China tariffs spark recession fears US Treasuries and dollar hit by sell-off, yields soar European stocks fall as US retaliatory tariffs take effect World markets face crisis-era volatility, stocks and commodities plungeAutor: Thomas Frank

11:20 2025-04-09 UTC+2

1375

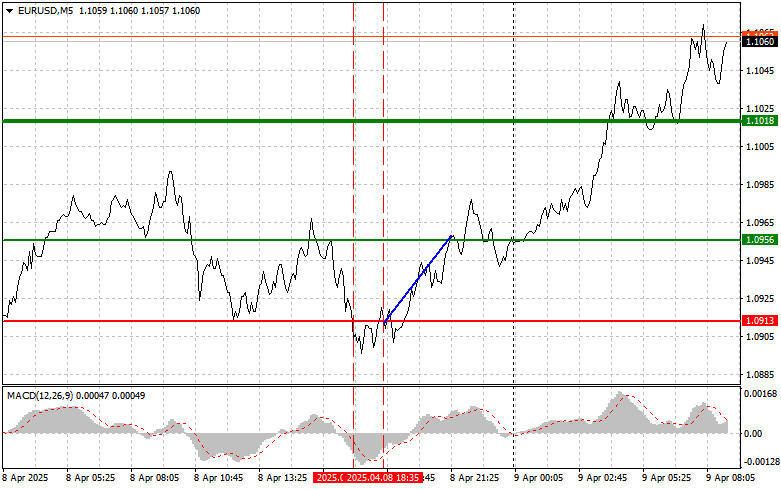

ForecastEUR/USD: Simple Trading Tips for Beginner Traders on April 9. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 9. Review of Yesterday's Forex TradesAutor: Jakub Novak

08:44 2025-04-09 UTC+2

1285

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 9-11, 2025: sell below $3,075 (21 SMA - 61.8%)

Technically, gold has been oversold since yesterday, so this rebound over the last few hours represents a technical correction. Therefore, we believe there could be consolidation below 3,085 in the coming days.Autor: Dimitrios Zappas

16:03 2025-04-09 UTC+2

1270

Bitcoin is taking a nosedive, funds are reporting losses, and analysts see no reason for growth.Autor: Ekaterina Kiseleva

12:07 2025-04-09 UTC+2

1255

Stock MarketsUS and China engaged in fierce battle: markets slump, high-tech stocks bruised, gold stands tall

Global markets are once again in turmoil: the escalation of the trade war between the US and China has slammed stock markets.Autor: Аlena Ivannitskaya

15:56 2025-04-09 UTC+2

1255

- Gold forecasts are becoming increasingly dazzling in every sense, as analysts appear to be competing with one another over how high the precious metal could go. Rising geopolitical instability and President Donald Trump's current

Autor: Larisa Kolesnikova

11:07 2025-04-09 UTC+2

1555

- The bulls are attempting to regain control, and we are currently observing increased activity and a push toward the peak of the ongoing correction at 1.1147. A breakout above this level would shift the market's focus to historical resistance at

Autor: Evangelos Poulakis

10:07 2025-04-09 UTC+2

1480

- Forecast

USD/JPY: Simple Trading Tips for Beginner Traders on April 9. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 9. Review of Yesterday's Forex TradesAutor: Jakub Novak

08:45 2025-04-09 UTC+2

1405

- Forecast

GBP/USD: Simple Trading Tips for Beginner Traders on April 9. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on April 9. Review of Yesterday's Forex TradesAutor: Jakub Novak

08:44 2025-04-09 UTC+2

1390

- Trump's China tariffs spark recession fears US Treasuries and dollar hit by sell-off, yields soar European stocks fall as US retaliatory tariffs take effect World markets face crisis-era volatility, stocks and commodities plunge

Autor: Thomas Frank

11:20 2025-04-09 UTC+2

1375

- Forecast

EUR/USD: Simple Trading Tips for Beginner Traders on April 9. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 9. Review of Yesterday's Forex TradesAutor: Jakub Novak

08:44 2025-04-09 UTC+2

1285

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 9-11, 2025: sell below $3,075 (21 SMA - 61.8%)

Technically, gold has been oversold since yesterday, so this rebound over the last few hours represents a technical correction. Therefore, we believe there could be consolidation below 3,085 in the coming days.Autor: Dimitrios Zappas

16:03 2025-04-09 UTC+2

1270

- Bitcoin is taking a nosedive, funds are reporting losses, and analysts see no reason for growth.

Autor: Ekaterina Kiseleva

12:07 2025-04-09 UTC+2

1255

- Stock Markets

US and China engaged in fierce battle: markets slump, high-tech stocks bruised, gold stands tall

Global markets are once again in turmoil: the escalation of the trade war between the US and China has slammed stock markets.Autor: Аlena Ivannitskaya

15:56 2025-04-09 UTC+2

1255

Zostať

Zostať