Podmienky obchodovania

Nástroje

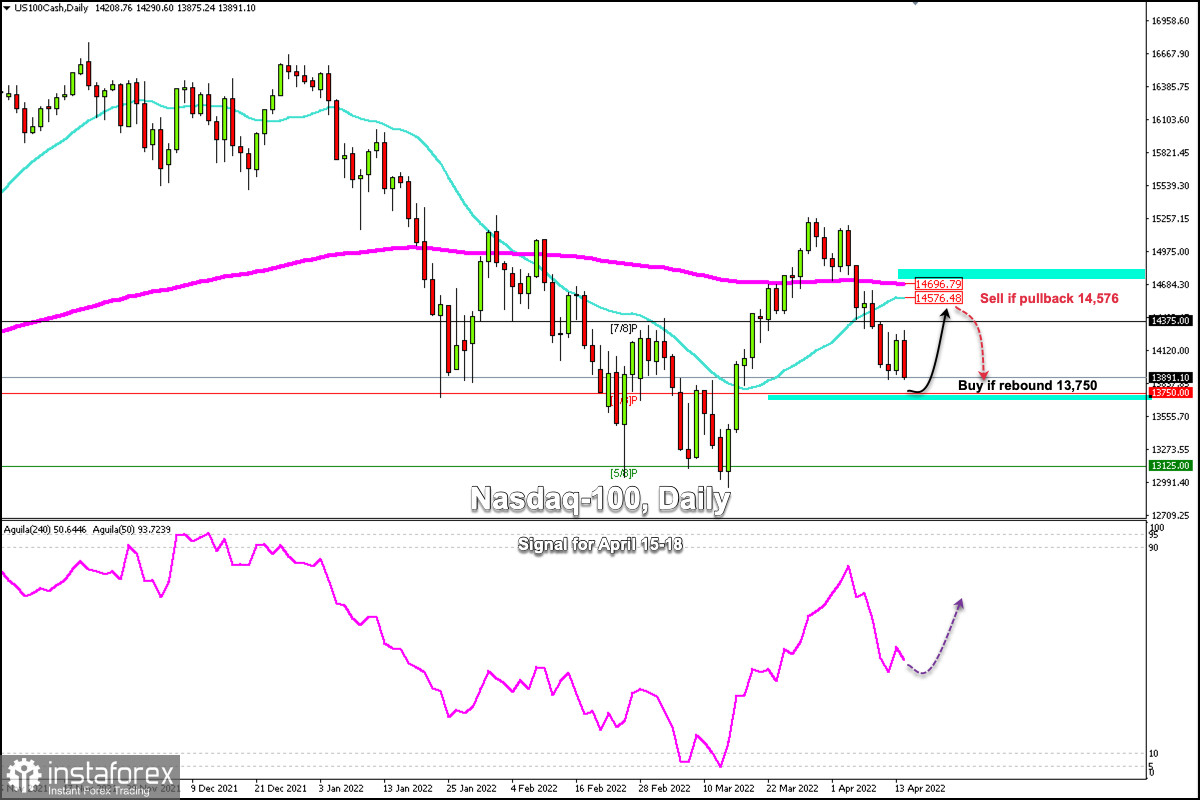

Since March 29, the Nasdaq-100 (#NDX) has been falling after reaching 15,275. It is currently trading at 13,891 on the daily chart and is located below the 200 EMA and below the 21 SMA which adds a negative outlook for the Nasdaq-100.

The Nasdaq 100, was the worst performer among the main US indices, accumulating a loss of around 2.3% on Thursday, retreating below the level of 14,000, and targeting the support of 6/8 Murray at 13,750.

The equity market will receive a barrage of new releases of profit or loss results from major companies that make up the Nasdaq-100 next week.

These reports could give the Nasdaq a technical bounce and its price reach the 21 SMA at 14,576.

US markets will be closed on Friday for the Easter holidays. The news that moved the market on Thursday can be digested from the Asian session on Monday.

Our trading plan for the next few days is to wait for a consolidation around 6/8 Murray at 13,750 to buy with targets at 14,120, and 14,375 as the index could hit the 200 EMA at 14,696.

A pullback towards 14,576 could be a selling opportunity as long as it consolidates or trades below 14,700. Additionally, with a sharp break below 13,750, the index could continue the downward movement and reach 13,125 (5/8 Murray).

The eagle indicator is with a negative bias, but it maintains the bullish signal which could favor the recovery of the Nasdaq-100 in the next few days.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

Súbory cookie môžeme používať na analýzu údajov o návštevníkoch webovej stránky, na jej zlepšenie a meranie výkonu reklamy. Tieto údaje sa vo všeobecnosti používajú na zlepšenie poskytovaných služieb na webovej stránke. Ďalšie informácie.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Zostať

Zostať