Podmienky obchodovania

Nástroje

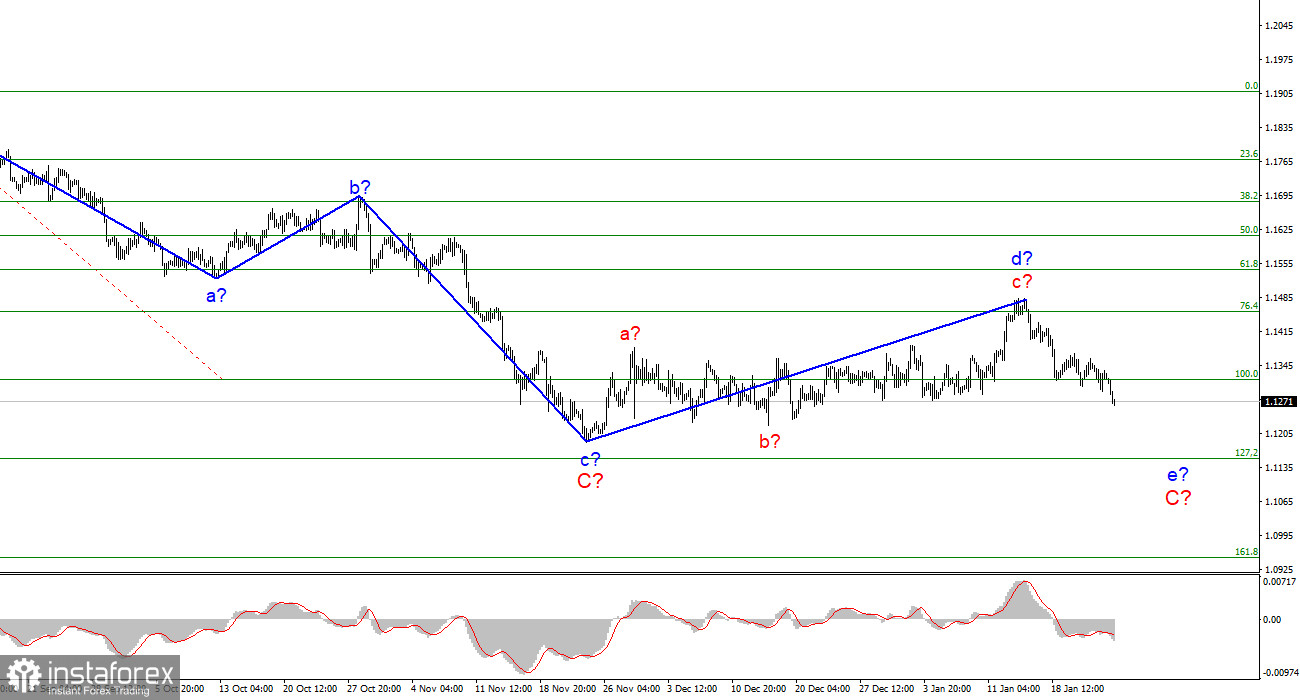

The wave marking of the 4-hour chart for the euro/dollar instrument still looks convincing. Wave d turned out to be longer than I originally expected, but this does not change the essence of the wave marking. I still believe that this wave is corrective, not impulsive, as evidenced by its internal wave structure. Therefore, it cannot be wave 1 of a new upward trend segment. If this is indeed the case, then the decline in quotes resumed within the framework of the expected wave e-C. In the near future, the quotes of the instrument may fall to the low of the expected wave c-C and a successful attempt to break this mark will indirectly confirm the current wave marking. I am not considering alternative options right now, since the wave pattern does not require this. A successful attempt to break through the 1.1315 mark indicates readiness for further sales of the European currency.

Fed Meeting: what you need to know the day before.

The euro/dollar instrument fell by 60 basis points on Tuesday. Thus, the market continues to get rid of the European currency. There was no news background today either in the Eurozone or in the US. Nevertheless, the decline in the quotes of the instrument continued throughout the day. From this, I conclude that in this way the markets are preparing for tomorrow's summing up of the FOMC meeting. This is the most important event of the week, but before it happens, I think we need to clearly understand what kind of world we are in. First, I consider it necessary to note the wave pattern once again. There are times when the wave picture is ambiguous, so the news background can just help to understand the prospects of the instrument. Now the situation is the opposite. It is the wave pattern that implies a further fall of the instrument in almost any case. Second, the results of the FOMC meeting will also be in favor of the US currency in almost any case. The only question is, what kind of decisions will the FOMC committee make? I think there is no doubt that the Fed will reduce the volume of asset purchases under the QE program. I still think the probability of an interest rate increase is small, but everything can be, given the inflation that is growing every month. Thus, I even urge you to be prepared for surprises from the FOMC. Although most likely, they will not be. Even the growth of the European currency is possible tomorrow evening if the Fed confines itself to only reducing the QE program. The market has long taken into account the complete curtailment of the incentive program, which should be completed by the end of March. Thus, this FOMC decision alone may not impress the market. However, in any case, we are talking about a slight rise in the instrument, after which its decline should resume. If the interest rate is raised already in January, the demand for the dollar may grow significantly, which will only accelerate the process of building the expected wave e- C.

General conclusions.

Based on the analysis, I conclude that the construction of the ascending wave d is completed. If this assumption is correct, then now it is necessary to sell the instrument based on the construction of the wave e-C with targets located near the estimated mark of 1.1154, which is equivalent to 127.2% Fibonacci. So far, there is no reason to expect the execution of an alternative option, which would involve a strong increase in the instrument. Only a small correction in the composition of wave e-C is possible.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

Súbory cookie môžeme používať na analýzu údajov o návštevníkoch webovej stránky, na jej zlepšenie a meranie výkonu reklamy. Tieto údaje sa vo všeobecnosti používajú na zlepšenie poskytovaných služieb na webovej stránke. Ďalšie informácie.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Zostať

Zostať