Podmienky obchodovania

Nástroje

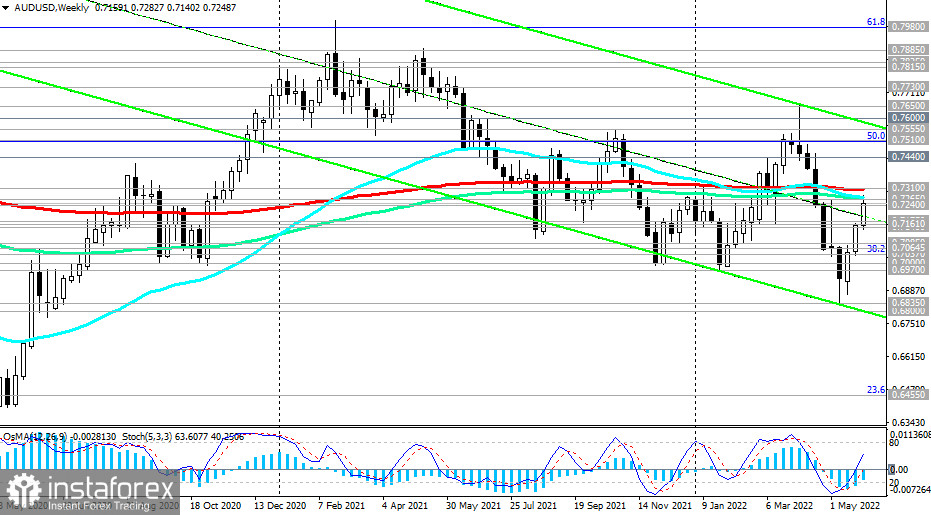

At the time of writing this article, AUD/USD is trading near 0.7248, remaining in a range between the most important long-term levels of 0.7265 (200 EMA on the daily chart), 0.7240 (144 EMA on the daily chart). If there is a rebound from these levels and AUD/USD resumes its decline, then we can say that the upward correction of the pair, which has been observed since mid-May, has ended and the price is returning to the global downward trend.

A confirmation signal for this will be a consecutive breakdown of 3 important support levels 0.7175 (50 EMA on the daily chart), 0.7161 (200 EMA on the 1-hour chart), and 0.7148 (200 EMA on the 4-hour chart).

The targets of this decline are located at the support levels of 0.6835 (local 2-year low), and 0.6800 (lower limit of the descending channel on the weekly chart).

At the same time, AUD/USD maintains a positive trend above the support levels of 0.7175, 0.7161, and 0.7148. The breakdown of the key resistance level 0.7265 and the resistance level 0.7310 (200 EMA on the weekly chart, 50 EMA on the monthly chart) creates the prerequisites for growth to the long-term resistance level 0.7600 (200 EMA on the monthly chart), which separates the global bull market from the bear market.

Support levels: 0.7240, 0.7175, 0.7161, 0.7148, 0.7085, 0.7064, 0.7037, 0.7000, 0.6970, 0.6835, 0.6800, 0.6450

Resistance levels: 0.7265, 0.7310, 0.7400, 0.7440, 0.7510, 0.7555, 0.7600, 0.7650

Trading Tips

AUD/USD: Sell Stop 0.7225. Stop-Loss 0.7290. Take-Profit 0.7200, 0.7175, 0.7161, 0.7148, 0.7085, 0.7064, 0.7037, 0.7000, 0.6970, 0.6835, 0.6800, 0.6450

Buy Stop 0.7290. Stop-Loss 0.7225. Take-Profit 0.7310, 0.7400, 0.7440, 0.7510, 0.7555, 0.7600, 0.7650

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

Súbory cookie môžeme používať na analýzu údajov o návštevníkoch webovej stránky, na jej zlepšenie a meranie výkonu reklamy. Tieto údaje sa vo všeobecnosti používajú na zlepšenie poskytovaných služieb na webovej stránke. Ďalšie informácie.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Zostať

Zostať