Podmienky obchodovania

Nástroje

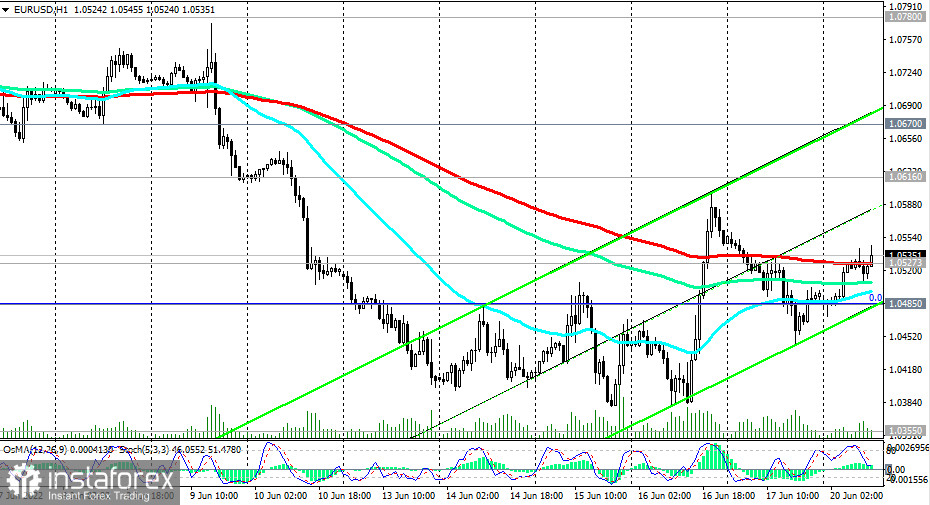

As of this writing, EUR/USD is trading near 1.0535, testing an important short-term resistance level at 1.0527 (200 EMA on the 1-hour chart).

In case of its breakout, the upward correction may continue to the resistance level of 1.0616 (200 EMA on the 4-hour chart).

EUR/USD is in the zone of a long-term bearish market below the key resistance levels 1.0955 (144 EMA on the daily chart) and 1.1085 (200 EMA on the daily chart). Therefore, for now, its further corrective growth will most likely be limited by the resistance level of 1.0670 (50 EMA on the daily chart), and in the main scenario, there will be a rebound from the resistance level of 1.0527.

A breakdown of the local support level 1.0485 will return downside risks to 1.0300, and further towards parity with the euro against the dollar against the backdrop of a steady strengthening of the dollar and a deterioration in the prospects for the Eurozone.

In an alternative scenario, the price will break through the resistance levels of 1.0527, 1.0616, and 1.0670 and grow to the local resistance levels of 1.0780, 1.0800, and 1.0810. Further movements will largely depend on the dynamics of the dollar and the actions of the Fed and the ECB regarding their monetary policies.

Support levels: 1.0500, 1.0485, 1.0400, 1.0355, 1.0300, 1.0200, 1.0100, 1.0000

Resistance levels: 1.0527, 1.0616, 1.0670, 1.0780, 1.0800, 1.0810, 1.0955, 1.1000, 1.1085

Trading Tips

Sell Stop 1.0470. Stop-Loss 1.0565. Take-Profit 1.0400, 1.0355, 1.0300, 1.0200, 1.0100, 1.0000

Buy Stop 1.0565. Stop-Loss 1.0470. Take-Profit 1.0616, 1.0670, 1.0780, 1.0800, 1.0810, 1.0955, 1.1000, 1.1085

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

Súbory cookie môžeme používať na analýzu údajov o návštevníkoch webovej stránky, na jej zlepšenie a meranie výkonu reklamy. Tieto údaje sa vo všeobecnosti používajú na zlepšenie poskytovaných služieb na webovej stránke. Ďalšie informácie.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Zostať

Zostať