Podmienky obchodovania

Nástroje

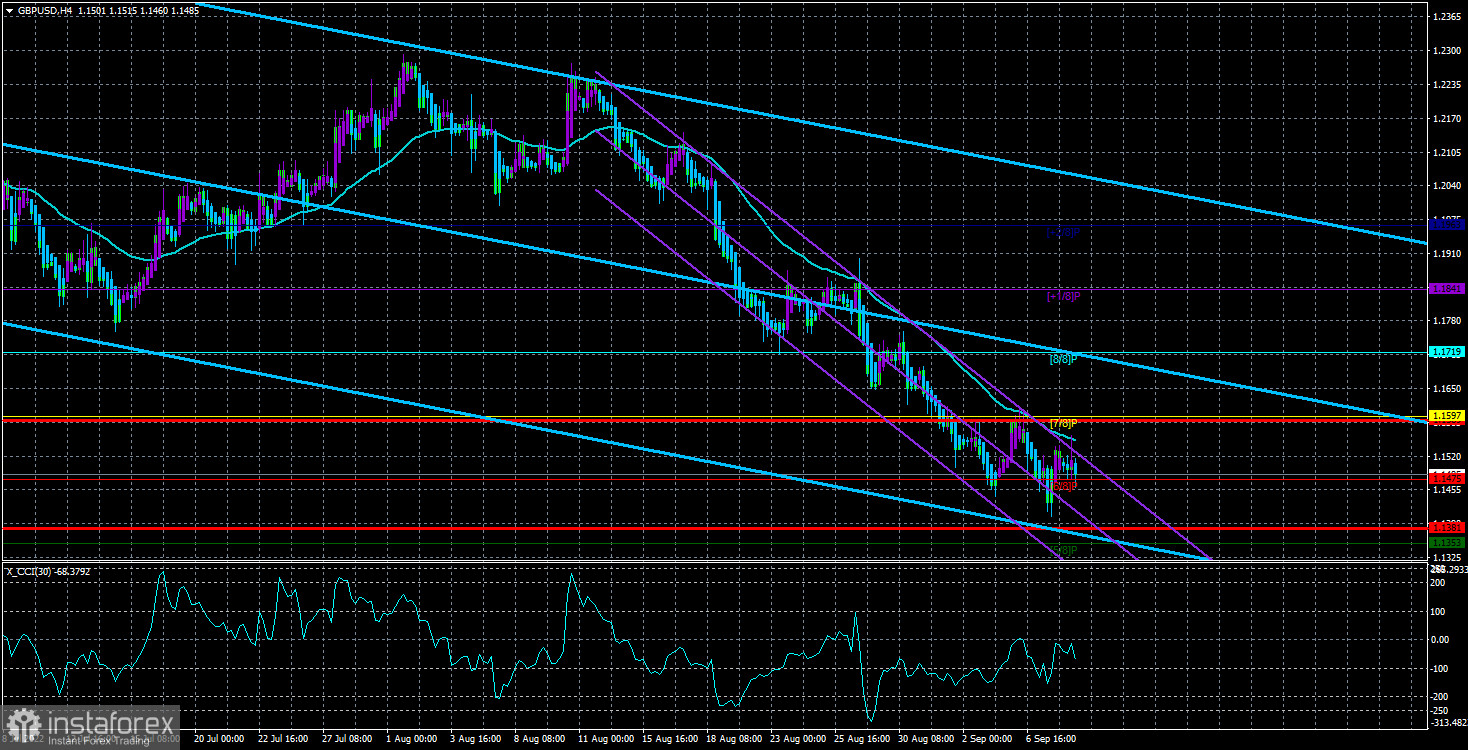

The GBP/USD currency pair continued to trade below the moving average line on Thursday and is near 37-year lows. In principle, it doesn't even make much sense to talk about fundamental, macroeconomic, or geopolitical backgrounds right now. The first and third remain unchanged, and there is nothing to add. Macroeconomics affects the pair's movement only locally and from time to time. Thus, the key factor is already technical. The "technique" clearly indicates a continuing downward trend, and the inability of the British currency to at least adjust after working out 1.1411 only shows that most market participants are still set up for sales and do not even want to fix profits on short positions. Recall that if traders cut their shorts, the pound would move up. But this is not happening. Of course, the pair can't stay in this mode forever. Only the last round of the downward movement has a length of about 800 points. Sooner or later, the "fairy tale for traders" with one-way traffic will end almost daily. However, it will be very difficult to predict the upward turn. We all know perfectly well that the market sells when there are reasons for this, and when there are none, it also sells.

Yesterday was as boring as possible in macroeconomic terms. There were no important reports in either the US or the UK. At least there was an ECB meeting in the European Union (which provoked not the strongest market reaction). The pound has adjusted to the moving average, bounced off it for the second time this week, and can now resume its decline. As you can see, for the market to sell the pair near its 37-year lows, even good reasons are not required. This month there will also be meetings of the Bank of England and the Fed, at which decisions will be made on raising key rates. But what will it change if BA raises the rate and the Fed raises it?

The UK economy will be on a swing.

Meanwhile, Liz Truss has officially assumed the post of Prime Minister of the United Kingdom and has already made several important statements. One of the Routes proposals is to freeze energy bills for British citizens at 2,500 thousand pounds per year. British households will not pay above this amount, and the program will be financed from the state budget. Naturally, this will create a "black hole" in the budget since no one knows how long gas prices will remain at their historical highs. It would be good if they started to fall, and European countries could solve the energy problem through supplies from other countries or alternative energy sources. But in the first case, the gas price will not change, and in the second – it will take years to transform the energy system. Therefore, in the short term, this plan may work and ease the pressure on the Bank of England, but in the long term, it will only increase the pressure on the economy.

Also, Truss has proposed lowering the value-added tax, but experts say that such a measure is only temporary relief for the British. After all, any reduction in budget revenues will lead to a deficit. Printing money now will lead to an even greater increase in inflation, which, according to many experts, will exceed the 13-15% expected by the Bank of England at its peak. Thus, there is only one way out – government loans. However, loans have one negative point – they will have to be repaid sooner or later. And they will have to be returned at the expense of the same state budget, and if there is no money in it, then technically, a technical default may occur. Therefore, the entire calculation is based on the fact that the gas problem is temporary. In a year or two, the situation will improve, the economy will come out of recession, the recovery will begin, and the growth of revenues to the state budget will begin. It will be possible to repay all loans and raise taxes again. Time will tell whether this plan will work.

The average volatility of the GBP/USD pair over the last 5 trading days is 104 points. For the pound/dollar pair, this value is "average." On Friday, September 9th, thus, we expect movement inside the channel, limited by the levels of 1.1381 and 1.1589. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward correction.

Nearest support levels:

S1 – 1.1475

S2 – 1.1353

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1597

R2 – 1.1719

R3 – 1.1841

Trading Recommendations:

The GBP/USD pair has adjusted to the moving on the 4-hour timeframe and is ready to resume the downward movement. Therefore, at the moment, new sell orders should be opened with targets of 1.1381 and 1.1353, which should be held until the Heiken Ashi indicator turns up. Buy orders should be opened when the price is fixed above the moving average line with a target of 1.1719.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

Súbory cookie môžeme používať na analýzu údajov o návštevníkoch webovej stránky, na jej zlepšenie a meranie výkonu reklamy. Tieto údaje sa vo všeobecnosti používajú na zlepšenie poskytovaných služieb na webovej stránke. Ďalšie informácie.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Zostať

Zostať