Podmienky obchodovania

Nástroje

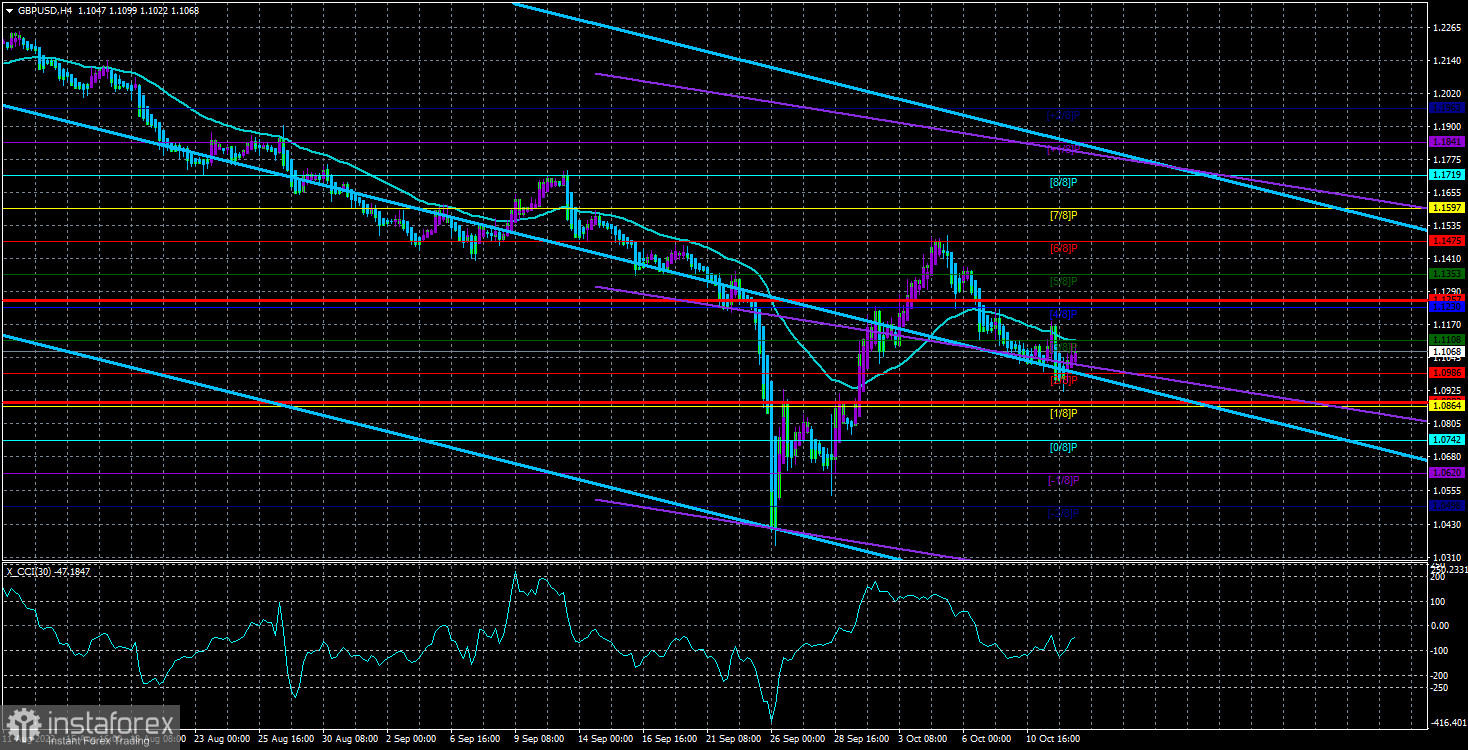

The GBP/USD currency pair continued to trade quite calmly on Wednesday, but the pair's volatility remains very high. Of course, it has been falling lately, but still, the pair passes at least 150 points per day in most cases. On Tuesday evening, the pound also made an upward surge, which ended safely near the moving average. The next day, the downward movement was already restored. The pound is having problems with the continuation of the fall, but the euro currency is also in place. Perhaps the market is waiting for today's report on inflation in the US, although, by and large, it is unlikely to affect the next Fed meeting, at which the rate is likely to rise by another 0.75% with a 99% probability. However, as long as the price is below the moving average, the pair is in a downward trend. On the 24-hour TF, the price still did not stay above the critical line, so we got another new factor in favor of the fall of the British currency.

It should also be noted that the British pound continues to slide quite actively. The Heiken Ashi indicator rarely draws purple bars, so there are practically no rollbacks and corrections. The foundation and geopolitics remain unchanged, but the UK has been famous for creating large-scale problems in recent years. It all started with Brexit, then the failed actions of the government during the pandemic, the resignation of Boris Johnson, criticism of Liz Truss, the initiative to lower taxes, the rejection of the initiative to lower taxes, and the interventions of the Bank of England to stabilize the debt market, which are nothing more than a program of new economic stimulus at a time when the Bank of England tightens monetary policy.

The Bank of England does not know what to do.

A few weeks ago, the British regulator officially stated that it intends to unload its balance sheet of 895 billion pounds by 80 billion. On September 28, it became known that the Bank of England was launching an intervention to stabilize the financial market due to the strong overvaluation of Treasury bonds (their yields). During this intervention, auctions for the purchase of Treasury bonds worth up to 5 billion pounds were held daily. Yesterday it became known that under the program due to end on October 14, the volume of bond purchases will be increased to 10 billion pounds per day. However, this only means that the Bank of England will try to buy bonds for such an amount. To buy them, you need to find someone to sell them to in such large volumes. If the BA goal is not achieved, this program, which is an analog of the QE program during the pandemic, can be extended.

But the start of the QT program, according to which BA's balance was to be reduced by 80 billion pounds (tightening monetary policy), which is one of the tools to combat high inflation, was postponed to October 31. That is, it may begin on October 31, and it may be much later. Thus, the British regulator continues to tighten monetary policy to suppress inflation (seven rate hikes) simultaneously as it weakens monetary policy to stabilize financial markets. However, traders do not even know how to react to everything happening. On the one hand, BA is raising the rate. On the other hand, it is buying bonds. On the third – the pound has already fallen to its absolute lows, so it may be dangerous to sell it again.

We believe that from the foundation's point of view and geopolitics, the pound can continue its fall completely freely. The current technical picture does not give us a single signal to buy. Moreover, the "prick" of absolute lows that happened a few weeks ago may be a non-standard pullback up by 1000 points after a drop of 1000 points. Those movements were similar to the end of a downward trend, but what can you do if current events and news do not give the market a reason to buy the pound?

The average volatility of the GBP/USD pair over the last five trading days is 187 points. For the pound/dollar pair, this value is "very high." On Thursday, October 13, thus, we expect movement inside the channel, limited by the levels of 1.0882 and 1.1257. The reversal of the Heiken Ashi indicator downwards signals the completion of the upward correction.

The nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

The nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading Recommendations:

The GBP/USD pair has started to adjust in the 4-hour timeframe but remains below the moving average. Therefore, at the moment, sell orders with targets of 1.0882 and 1.0864 should be considered in case of a reversal of the Heiken Ashi indicator down or a rebound from the moving. Buy orders should be opened when the price is fixed above the moving average line with targets of 1.1230 and 1.1257.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

Súbory cookie môžeme používať na analýzu údajov o návštevníkoch webovej stránky, na jej zlepšenie a meranie výkonu reklamy. Tieto údaje sa vo všeobecnosti používajú na zlepšenie poskytovaných služieb na webovej stránke. Ďalšie informácie.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Zostať

Zostať