Condiciones de negociación

Products

Herramientas

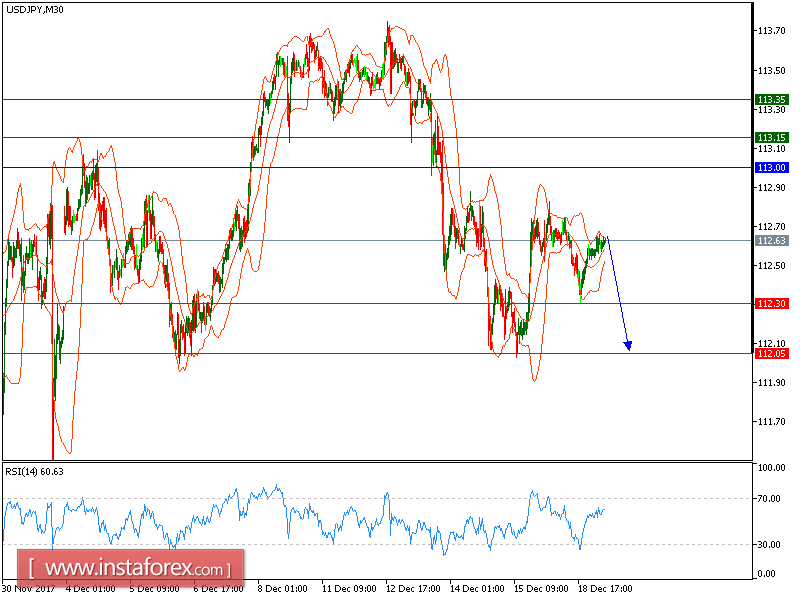

USD/JPY is expected to trade with bearish outlook as Key resistance at 113.00. The pair is rebounding from a low of 112.29 seen yesterday (December 18) but remains capped by the key resistance at 113.00. Currently, the pair is trading at levels around the 50-period moving average. The relative strength index stands above the neutrality level of 50, indicating that the rebound may proceed for a while.

However, as long as 113.00 is not surpassed, the intraday outlook remains bearish and the pair could return to 112.30 on the downside.

Alternatively, if the price moves in the opposite direction, a long position is recommended above 113.00 with a target of 113.15.

Chart Explanation: The black line shows the pivot point. The current price above the pivot point indicates a bullish position, while the price below the pivot point is a signal for a short position. The red lines show the support levels and the green line indicates the resistance level. These levels can be used to enter and exit trades.

Strategy: SELL, Stop Loss: 113.00, Take Profit: 112.30

Resistance levels: 113.15, 113.35 and 113.65 Support Levels: 112.30, 112.05, 111.70

¡Los informes analíticos de InstaForex lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaForex, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.

Podemos utilizar cookies para analizar los datos de nuestros visitantes, mejorar nuestro sitio web y medir el rendimiento de la publicidad. En general, estos datos se utilizan para ofrecer una mejor experiencia en el sitio web. Más información.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Permanecer

Permanecer