Condiciones de negociación

Products

Herramientas

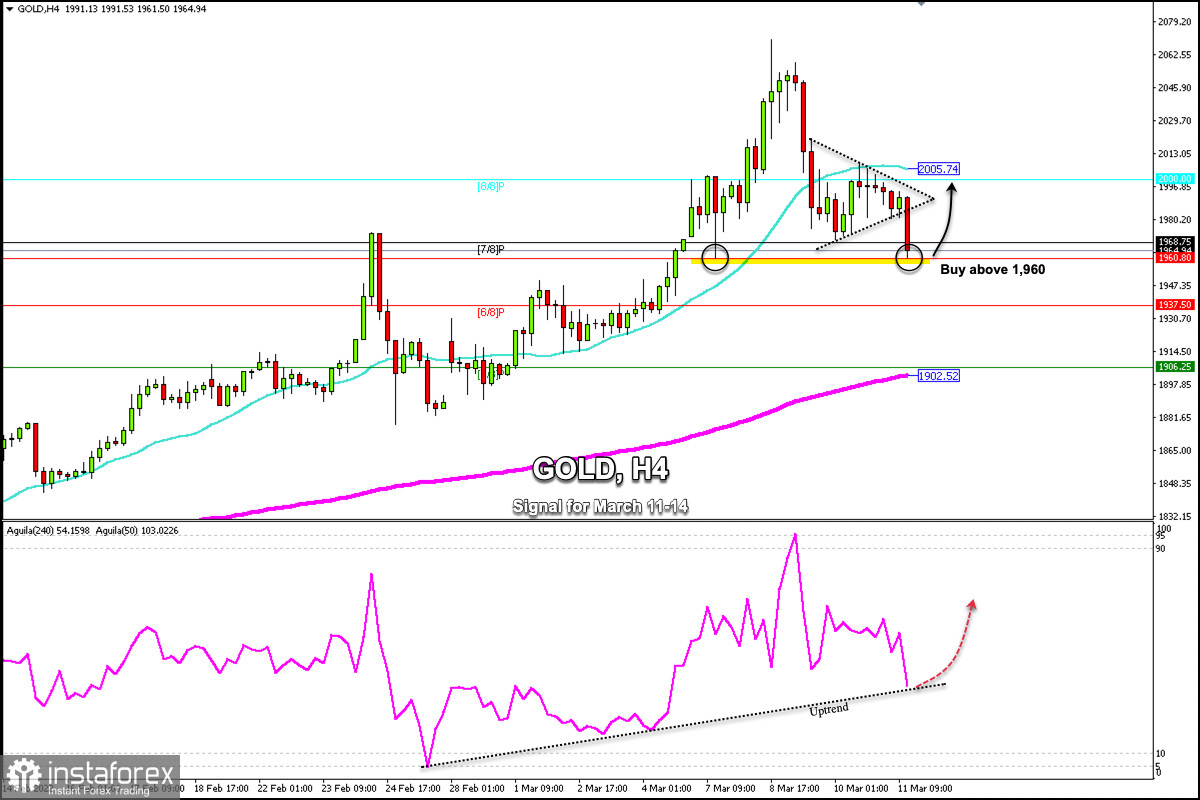

Early in the American session, gold reached the support level of 1,960. This level coincides with the low of March 7. If the price consolidates above this level in the next few hours, it could confirm the formation of a double bottom pattern.

Hopes of finding a path that would lead both countries to a peaceful solution caused a sharp pullback in gold and it is now hovering around 1,960. A break and consolidation below this level could accelerate the decline towards the support 6/8 Murray at 1,937.

However, the talks held in Turkey did not achieve any progress and, once again, investors could take refuge in gold seeking protection against the possible global recession that the war would generate.

In the European session, gold broke out the symmetrical triangle pattern and found support around 7/8 Murray and 1,960. This technical correction in gold is likely to give the bulls a chance for a positive move in the coming days.

Given that gold was trading at extremely overbought levels, this correction was expected in the last few hours and could also be part of profit-taking by investors. Another factor that is eroding the strength of gold is the slight increase in demand for risky assets. Wall Street indices are trading in the green which affects the strength of gold.

In the medium term, gold should continue its rise if the situation in Ukraine worsens or if inflation gets out of control.

Investors have their eye on the expected interest rate hike for part of FED next week as it could dampen the strength of gold, only if the interest rate increase is about 50bp.

Our trading plan is to wait for a bounce around 1,960 to buy, with targets at 1,985 and the level SMA 21 at 2,005. The eagle indicator has touched the support level of the uptrend channel which could favor a recovery in gold.

¡Los informes analíticos de InstaForex lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaForex, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.

Podemos utilizar cookies para analizar los datos de nuestros visitantes, mejorar nuestro sitio web y medir el rendimiento de la publicidad. En general, estos datos se utilizan para ofrecer una mejor experiencia en el sitio web. Más información.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Permanecer

Permanecer