Condiciones de negociación

Products

Herramientas

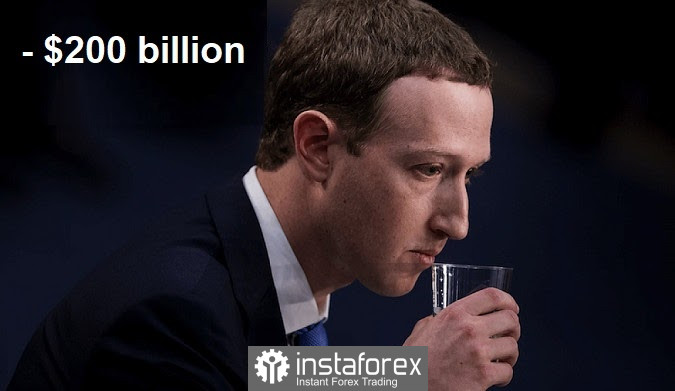

US stocks edged lower on Thursday because of disappointing results from Meta Platforms. ECB concerns on the persistently high inflation halted stock rally as well.

Both the S&P 500 and Nasdaq 100 posted declines after Meta reported more than $200 billion loss in its market value.

The weak performance from US tech giants surprised investors because most hoped for a strong reporting season that would keep stocks attractive. Supposedly, growth in earnings will allay some of their fears, especially in monetary tightening. After all, have swung sharply after markets officials cut stimulus to curb inflation.

"As focus on large-scale advanced-country monetary policy and investor sentiment around the world shifts, economic activity data releases will be the key," said Marilyn Watson, head of global fixed income fundamental strategy at BlackRock.

On a different note, growth in the US services sector slowed in January, while initial jobless claims fell more-than-expected last week to 238,000. Tom Essaye, a former Merrill Lynch trader who founded "The Sevens Report" newsletter, said the upcoming report on US payrolls will remind everyone that Fed policy expectations are a key influence on the markets because if data, especially inflation, exceed expectations, the Fed will be forced to tighten policy, which would return market volatility. "The bottom line is that Fed policy is still very important to this market," Essaye said.

Other key events for today are:

- earnings reports from Amazon and Ford Motor;

- US payrolls report for January (Friday);

- start of Winter Olympic Games in China (Friday)

¡Los informes analíticos de InstaForex lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaForex, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.

Podemos utilizar cookies para analizar los datos de nuestros visitantes, mejorar nuestro sitio web y medir el rendimiento de la publicidad. En general, estos datos se utilizan para ofrecer una mejor experiencia en el sitio web. Más información.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Permanecer

Permanecer