Condiciones de negociación

Products

Herramientas

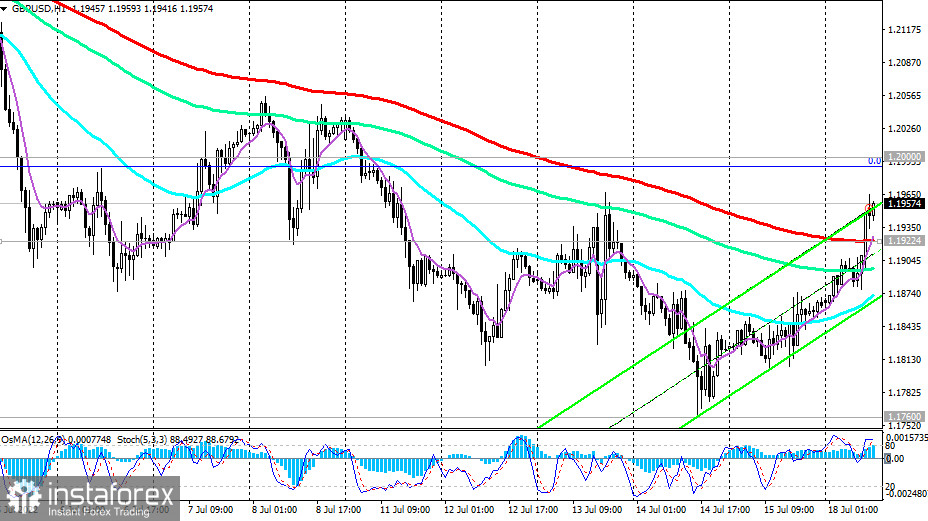

The GBP/USD is growing today, having received an impulse from the dollar, developing a downward correction.

As of this writing, GBP/USD is trading near the level of 1.1957, having broken through the important short-term resistance level of 1.1922 (200 EMA on the 1-hour chart) at the beginning of today's European session, thus placing an order for a possible continuation of growth.

If this upward correction continues, GBP/USD will move towards the resistance level of 1.2151 (200 EMA on the 4-hour chart) and break through 1.2200, through which the upper limit of the descending channel passes on the daily chart. The limit of the upward correction is around the resistance level of 1.2260 (50 EMA on the daily chart). The dynamics of GBP/USD is still dominated by bearish momentum, which forced the pair to update its more than 2-year low last week (since April 2020).

And since trends do not break so quickly, it is logical to assume the resumption of the downward dynamics of GBP/USD. And the trigger may be the publication (tomorrow or Wednesday) of important macro statistics for the UK if it turns out to be negative or weak.

In an alternative scenario, the growth of GBP/USD will continue above the resistance level of 1.2260. This scenario is unlikely, but it still has the right to be, especially if very weak macro data comes from the US, although there are not so many of them this week.

In the main scenario, we expect a resumption of the decline either near the local resistance level of 1.2000 or near the levels of 1.2075, 1.2100, 1.2150. Therefore, it would be logical to place pending orders (Sell Limit) for sale here.

A confirmation signal will be a breakdown of the support level of 1.1922.

Support levels: 1.1922, 1.1900, 1.1800, 1.1760

Resistance levels: 1.2000, 1.2151, 1.2260, 1.2400, 1.2600, 1.2645, 1.2700, 1.2735, 1.2900, 1.3000, 1.3100, 1.3210, 1.3300

Trading Tips

Sell Stop 1.1930. Stop-Loss 1.2015. Take-Profit 1.1900, 1.1800, 1.1760, 1.1700

Buy Stop 1.2015. Stop-Loss 1.1930. Take-Profit 1.2100, 1.2151, 1.2260, 1.2400, 1.2600, 1.2645, 1.2700, 1.2735, 1.2900, 1.3000, 1.3100, 1.3210, 1.3300

¡Los informes analíticos de InstaForex lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaForex, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.

Podemos utilizar cookies para analizar los datos de nuestros visitantes, mejorar nuestro sitio web y medir el rendimiento de la publicidad. En general, estos datos se utilizan para ofrecer una mejor experiencia en el sitio web. Más información.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Permanecer

Permanecer