Condiciones de negociación

Products

Herramientas

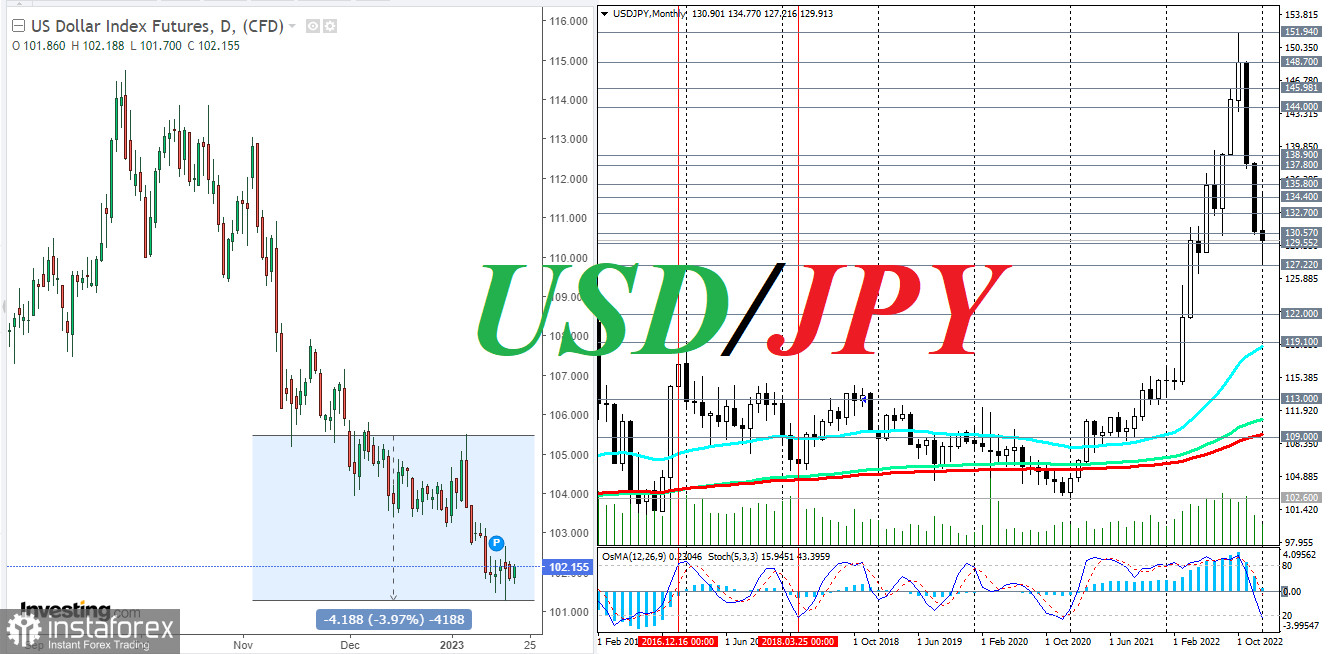

The yen is getting weaker again and this is likely due to the Bank of Japan meeting earlier in the week. As you know, the BOJ decided to keep the current monetary policy unchanged, leaving the interest rate on the negative side. The Japanese central bank also left its yield curve control measures unchanged. At the previous meeting in December, the BOJ widened the target range for its 10-year government bond yield, to a range of -50.0 points to +50.0 points relative to the 0.0% target.

This caused the yen to strengthen sharply at the time. Although the interest rate was kept at -0.10% and BOJ Governor Haruhiko Kuroda reiterated his mantra that the bank's management "will not hesitate to ease monetary policy further if necessary," the market took such actions as the beginning of a possible abandonment of ultra-loose monetary policy: since the 1990s the BOJ has aimed to fight deflation by keeping the interest rate in negative territory and bond yields near zero values. Now market participants are seriously expecting that the BOJ may tighten its rhetoric in April, when the current head of the central bank Kuroda will resign, and soon after that he will begin to curtail the stimulus policy.

On that day (December 20, 2022), the USD/JPY was down almost 4%, losing 520 pips on the day and closing the trading day near 131.70, but still up 113 pips from an intraday low of 130.57, with intraday volatility of 690 pips.

On Friday, the yen was getting weaker and the USD was rising, recovering from this and last month's big losses and was trading near 130.00.

After Wednesday's meeting, Kuroda said no policy adjustments are needed and that we should wait for the results of the measures already taken, although the Bank expects consumer prices to rise to 3.0% in March. But economists expect the figure to fall to 1.6% next year, below the 2.0% target.

The yen was also under pressure due to the data on machinery orders, presented earlier this week. Thus, in November their number in annual terms decreased by -3.7% after growth of +0.4% a month earlier, although economists expected an acceleration of growth of the index to +2.4%. In monthly terms, the index declined by -8.3%.

The country's industrial production, though up +0.2% after a -0.1% decline a month earlier, declined by -0.9% year on year in November, according to data published last Wednesday. This is very negative for Japan's export-oriented economy, where the industrial sector plays a key role.

Considering the strengthening of the dollar on Friday and the uncertainty of the stock market, where futures on major global stock indices are traded in narrow ranges, we should probably expect USD/JPY to rise towards the nearest important resistance level of 132.70

¡Los informes analíticos de InstaForex lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaForex, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.

Podemos utilizar cookies para analizar los datos de nuestros visitantes, mejorar nuestro sitio web y medir el rendimiento de la publicidad. En general, estos datos se utilizan para ofrecer una mejor experiencia en el sitio web. Más información.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Permanecer

Permanecer