Condiciones de negociación

Products

Herramientas

EUR/USD

Higher Time Frames

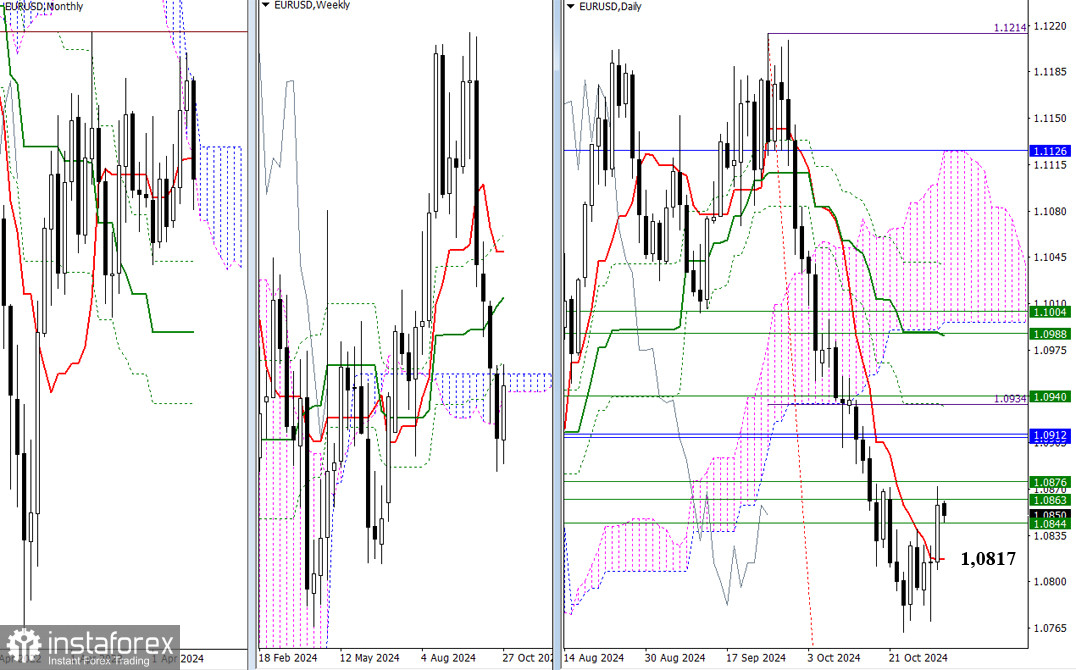

Yesterday, the bulls climbed above the daily short-term trend (1.0817) but couldn't break through the weekly resistances (1.0844 – 1.0863 – 1.0876) on the first attempt, leaving this task still relevant. Today marks the end of the month. October has been dominated by bearish sentiment, and the focus now is on the length of the lower shadow of the monthly candle and whether the bears can close the month as optimistically as possible.

H4 – H1

In the lower time frames, the bulls currently hold the advantage. They may soon leave the H4 cloud and form an upward target for breaking through it. As a result, additional targets in the form of classic Pivot levels (1.0884 – 1.0909 – 1.0947) will be added to the H4 targets during the day. If the bears gain control, the most crucial target for corrective decline would be the weekly long-term trend (1.0819). A breakthrough and reversal of this trend could shift the current balance of power. The following downside targets during the day will be the support levels of classic Pivots levels (1.0783 – 1.0758).

GBP/USD

Higher Time Frames

As October draws to a close, the bears have returned to the weekly medium-term trend (1.2939). Today, we close the month. The bears will strive to secure a solid bearish result, and the effectiveness of this effort will be evaluated tomorrow. The bulls' immediate targets today are 1.2980 (daily short-term trend) and 1.3049-56 (lower boundary of the daily cloud + weekly Fibo Kijun). For the bears, a move beyond 1.2939 would open the path to 1.2864 (monthly short-term trend).

H4 – H1

On the lower time frames, the market has recently been hovering around the key levels of 1.2980 – 1.2975 (central Pivot point of the day + weekly long-term trend), which are currently horizontal, supporting uncertainty. Breaking out of this zone and strengthening the direction of either side will lead to a decisive movement. For the bulls, targets would be the classic Pivot resistance levels (1.3023 – 1.3086 – 1.3129), while for the bears, they would be the support levels (1.2917 – 1.2874 – 1.2811).

Technical Analysis Tools Used:

¡Los informes analíticos de InstaForex lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaForex, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.

Podemos utilizar cookies para analizar los datos de nuestros visitantes, mejorar nuestro sitio web y medir el rendimiento de la publicidad. En general, estos datos se utilizan para ofrecer una mejor experiencia en el sitio web. Más información.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Permanecer

Permanecer